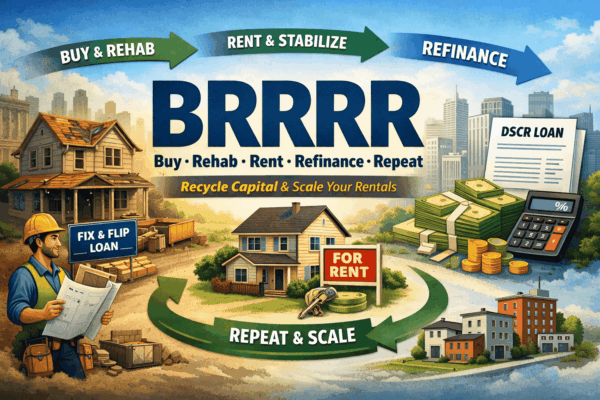

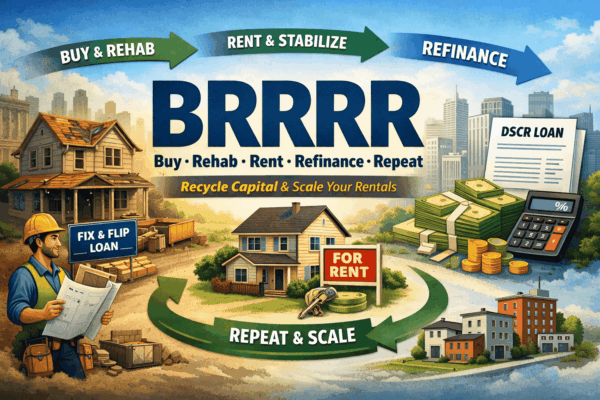

Master the BRRRR Strategy With Fix-and-Flip + DSCR Loans

Reading Time: 6 minutesWant to scale rentals without constantly saving for the next down payment? BRRRR can help you recycle capital— if the numbers work at each stage.

Estimate your potential house flip profit with ease — customize timelines and include all costs to review true profit potential.

The VP Capital Lending Fix and Flip Calculator provides estimates for informational purposes only. Results do not encompass all loan programs and may vary based on specific program limits. Qualifications, rates, and payments depend on timing and individual circumstances and are subject to change. This is not a commitment to lend.

Loan Amount: $273,125

Loan Type: 12-Month Fix and Flip Loan

Interest Rate: 10.89%

Monthly Payment: $1,888.73 (interest-only)

Points: 1.77% (due at closing)

Loan-to-Value (LTV): 92.5%

One point equals 1% of the loan amount. This payment estimate excludes taxes and insurance, as this is a 12-month interest-only loan. Rates shown are valid as of September 01, 2025.

* If amounts for other monthly expenses and sale costs were not entered, they were excluded from your calculation results. This does not account for all possible fees or closing costs.

See your real numbers in just a few clicks. Apply now—no impact on your credit!

Discover your property’s potential with a free Official Flip Review — let’s explore how to make the numbers work for you!

Estimate how much you can borrow based on your property's cash flow. Perfect for buy-and-hold investors.

Thinking about buying a home? Use our calculator to get an estimate of what your monthly mortgage payments could look like.

Need Assistance? Connect with a Load Advisor Today!

Our Fix and Flip calculator provides estimates based on the numbers you enter, so it’s great for getting an initial sense of costs and returns. Just remember, some numbers may shift between when you apply and when your loan closes. For example, we might need to adjust your loan amount after receiving the appraisal report.

The best way to get a more precise idea? Just give us a call, and we'll be happy to help!

A 20% down payment used to be the standard, but things have changed. While putting down 20% can still get you the best rates and loan options, there are plenty of flexible options now. Depending on your situation, you might be able to get started with as little as 8% to 10% down.

Your interest rate—the cost of borrowing—is influenced by several factors, like your loan type, loan amount, down payment, credit history, and experience. Rates can also fluctuate with market trends. We’ll work with you to find the best rate based on your goals and profile.

For a Fix and Flip loan, your monthly payment is interest-only, meaning you’re only paying interest on the outstanding loan balance. This keeps payments lower while you work on the property.

The best loan is one that aligns with your investment goals and situation. Factors like credit profile, property type, experience level, and down payment all play a role. Not sure what’s right for you? Our Loan Advisors are here to answer your questions and help you find options that fit you best.

A Loan Advisor will review your information and get you an estimate of what you could spend on your property—all without affecting your credit.

Our experienced Loan Advisors are here to answer your questions, offer insights, and guide you confidently through every step of the process.

With us by your side, finalize your loan and secure the best terms for your investment. Your dedicated team will be with you every step of the way, ensuring a smooth process and answering any question along the way.

Reading Time: 6 minutesWant to scale rentals without constantly saving for the next down payment? BRRRR can help you recycle capital— if the numbers work at each stage.

Reading Time: 3 minutesFlipping houses can be a profitable venture, but without a solid budget, unexpected costs can quickly eat into your profits.

Reading Time: 3 minutesIf you’re ready to dive into the world of real estate investing, house flipping is one of the most exciting